It seems like everyone around you is telling you to invest in real estate. A barrage of influencer content constantly hits the media platforms telling you to put your savings into real estate investments to build passive income. Passive income is income earned from an investment without doing any extra work. All you have to do is sit back and let the money roll in — or so the story goes.

But is buying real estate truly passive income? In most cases, I’d argue it isn’t. From construction upkeep to managing rental tenants to dealing with regulatory paperwork, owning real estate is rarely as passive as the investing influencers claim it to be. True passive income comes from dividend investing. Owning dividend-paying stocks allows you to get an income stream while doing zero work. What an incredible invention.

The best dividend stocks are ones that grow their dividend payments each year. That brings us to Philip Morris International (NYSE: PM), a top dividend growth stock with a high starting yield. You can buy $25,000 of this dividend growth stock today and earn $1,000 in growing passive income each year.

Let’s find out why this nicotine company is such a strong dividend growth stock for investors in 2024.

Growing tobacco earnings

Philip Morris International owns the international Marlboro brand, making it one of the leading tobacco/cigarette makers outside the United States and China. While cigarette use is declining worldwide, Philip Morris is in a much better position than other companies given its exposure to regions with fast-growing populations and (generally) emerging economies.

You can see this in its volume results. In the first half of 2024, Philip Morris’ cigarette volumes were actually flat year over year at 300 billion units. Add in pricing power, and cigarette net revenue grew 4.3% in the first half of the year. This is despite continued headwinds from the U.S. dollar appreciating versus foreign currencies. The dollar index soared at the beginning of 2022, reducing earnings for Philip Morris in U.S. dollar terms. Now, this headwind has stabilized, which is good news for Philip Morris.

As the company steadily raises prices, the legacy cigarette business should contribute to growing profits for Philip Morris in the coming years. It makes up the majority of its $13.4 billion in annual operating earnings right now.

Switching millions to different nicotine categories

Cigarettes are not all of Philip Morris’ business — far from it. The company has invested tens of billions of dollars into alternative nicotine products, such as heat-not-burn units and tobacco-free nicotine pouches. The smoke-free segment is growing like gangbusters with revenue up 21.3% in the first half of 2024. Zyn — the company’s tobacco-free nicotine pouch brand — is growing volumes in the United States by over 50% year over year. It is growing so quickly that the product has actually hit some supply shortages.

These categories have not generated much in profits until recently. As management invests to grow the brands around the world, it has come at the cost of Philip Morris’ profit margins in the short term. Luckily, these margin woes seem to finally be reversing. After falling for several years, Philip Morris’ operating margin grew to 36.7% over the last 12 months. As these new nicotine products continue to scale, investors should expect profit margin expansion to continue as well.

Buy for growing dividends and true passive income

Philip Morris’s dividend is currently yielding 4.5%. On a $25,000 investment, that can generate over $1,000 in passive income each year. Of course, you should not make Philip Morris International the only stock you own, so a $25,000 investment is not for everyone — it’s an illustration of the passive income one can generate from high-dividend-yielding stocks. This stock should be a part of a diversified portfolio.

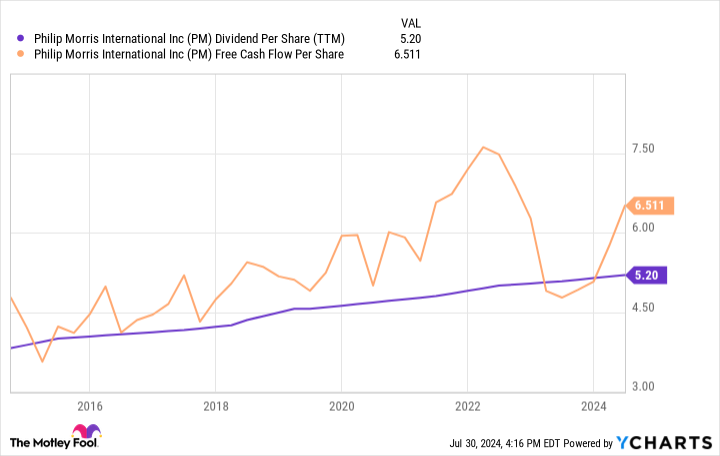

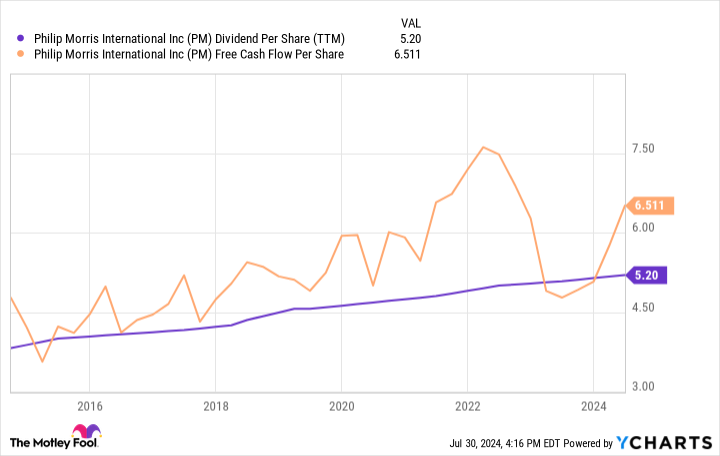

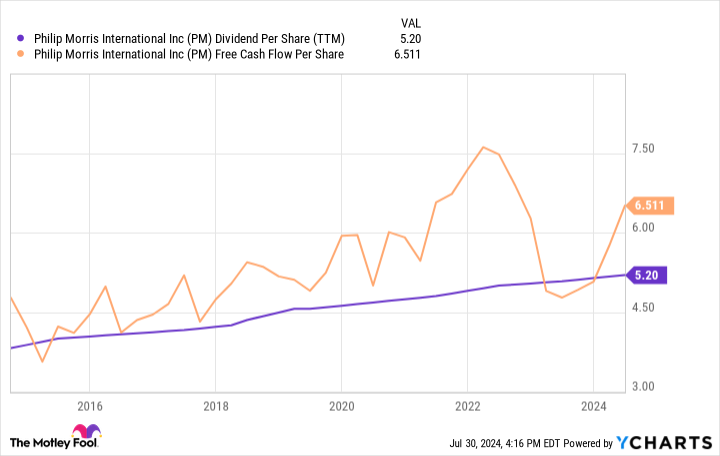

The best part about Philip Morris is that the company is poised to grow its dividend per share at a healthy rate over the next decade. At a trailing dividend per share of $5.20, Philip Morris’ dividend payout is significantly lower than its free cash flow per share of $6.50. And this free cash flow number is still depressed as it rolls out new products around the world. Over the next three to five years, I expect free cash flow per share to inflect closer to $10, especially if management begins to repurchase stock.

That gives Philip Morris International the capacity to sustainably double its dividend per share over the next five to 10 years. At a starting yield of 4.5%, this looks like the ultimate growth stock for investors to buy and hold for the long term.

Should you invest $1,000 in Philip Morris International right now?

Before you buy stock in Philip Morris International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Philip Morris International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

Forget Real Estate: Invest $25,000 in This Ultimate Dividend Growth Stock and Get $1,000 in Passive Income was originally published by The Motley Fool